Three years after the passage of a hefty property tax relief package, it’s time to renegotiate the path forward.

On Tuesday, Speaker of the House Mike Moyle, R-Star, got the go-ahead from the House Revenue and Taxation Committee to introduce a new property tax relief bill with $50 million of new funds to put toward reducing the tax burden on homeowners statewide. This continues the work of HB 292, a property tax package negotiated in 2023, with hundreds of millions of relief over the course of three years in two different funds.

Now that this package is set to expire soon, this new proposal from Moyle would put an additional $50 million into the initiative going forward for homeowners on their primary property. This goes on top of the $50 million set annually to go toward helping pay off school bonds, levies and build facilities across the state funded by online sales tax revenue.

“There’s more to do in property tax relief but this is a start to get us there,” Moyle said. “One of the concerns I’ve had as we look at property taxes is if we had my way I’d get rid of them all the way, but I don’t know how to crack that nut.”

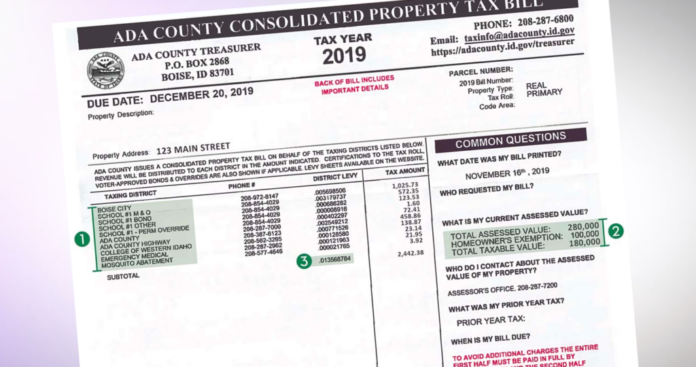

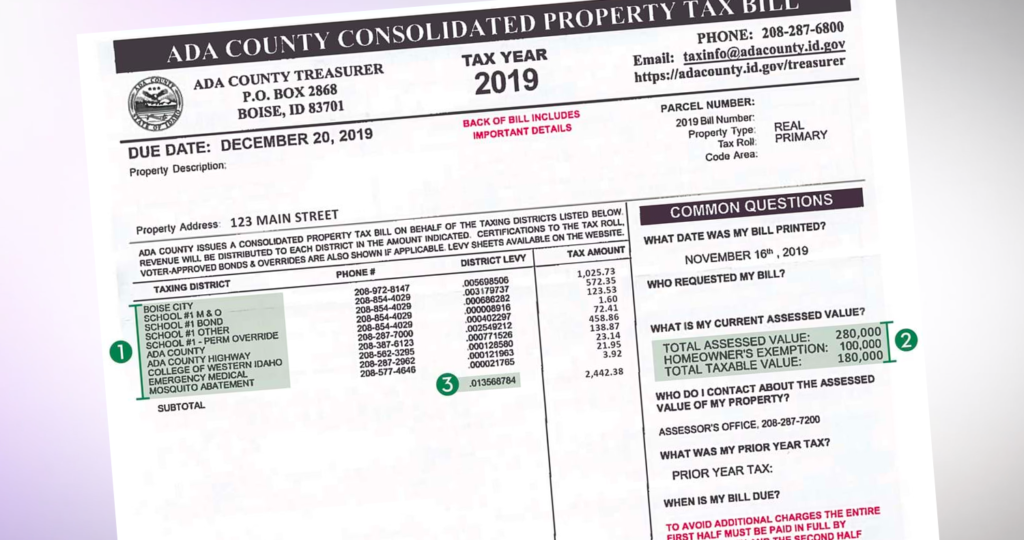

It’s unknown exactly how much relief per homeowner this would translate to at this point in the year. For example, Ada County got $99 million from the initial property tax package in 2023 across both funds. The median Ada County home that year, valued at $438,000 for this tax year, got $526 off of their property tax bill in total that year. For homeowners who didn’t qualify for the homeowners’ exemption, the median-valued home will get $117 off due to the part of the program paying off school bonds and levies for all property owners, not just those who own the homes they live in.

This goes along with two other bills introduced by House Republican leadership so far this session. Moyle introduced an income tax cut bill reducing both individual and corporate tax rates last week and House Majority Leader Jason Monks, R-Meridian, introduced a bill to increase the grocery tax credit Monday.

How does it work?

The property tax package this builds on has two major components.

The first takes state funds and distributes them to properties with a homeowners exemption. Instead of past proposals that would shift property burdens around or constrict local government budget cuts, this would just use the money to give a rebate to the property tax owner that keeps the local government budget whole while also giving the homeowner a break. This year’s bill will take $50 million from an old school facilities fund the legislature canceled to put toward homeowners directly for the upcoming fiscal year only.

The second part distributes state funds to school districts based on their average daily attendance. Districts can pay off any school bonds, which are paid for with property taxes, then any levies or if they have none or if there is money left over, it can be saved to build new schools. And in the future, this money can be used to bond against borrowing money for new school upgrades without having to ask voters to approve property tax hikes to pay for it.

Under the 2023 proposal, 20% of the state’s revenues from online sales tax will be sent to the school facilities fund for tax relief. This bill would add an additional $50 million on top of it each year going forward.