Voters in the areas of McCall and Donnelly will be asked to approve the creation of a new taxing district on Nov. 4 that would raise short-term lodging costs.

The proposed Mountain Community Center District would levy a room tax of up to 5% on short-term stays to fund an indoor fieldhouse and recreation center. The district would not be authorized to levy property taxes under a court-approved petition.

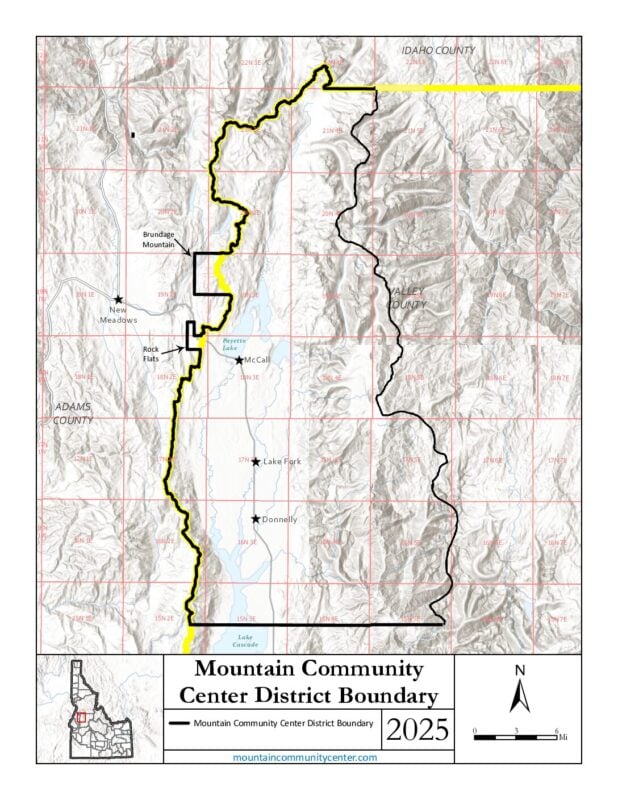

The tax, estimated to generate $1.5 million per year, would apply to all stays in short-term rentals and motels in the northern half of Valley County, including Tamarack Resort and the cities of Donnelly and McCall. Brundage Mountain Resort in Adams County would also be included in the district.

A location for the indoor fieldhouse and recreation center has not yet been selected and plans for the 120,000-square-foot facility are still being developed. A video rendering shows conceptual plans for the facility, which is currently estimated to cost between $20 million and $35 million to build and about $500,000 per year to operate.

Initial construction would mainly establish a walking track surrounding indoor sports fields, but future expansions could add pickleball courts, a swimming pool, an indoor gym, and other recreational amenities, according to the district’s organizers.

Approval of the district requires a simple majority of voters to be in favor, or 50% of votes plus one. Only residents within the district are eligible to vote.

Early votes can be cast at the Valley County Courthouse in Cascade, Monday through Friday from 8 a.m. to 5 p.m. through Oct. 31.

Election Day voting will be held on Nov. 4 from 8 a.m. to 8 p.m. at polling sites in McCall and Donnelly.

Greg Pittenger, Lisa Beck, Blake Lingle, Heidi Wyman, and Johanna Defoort, who are all among the volunteer group proposing the district, would be elected to the district’s board of directors if the measure is passed by voters.

What do proponents say?

The district’s organizers say the tax of up to 5% on short-term lodging would help fill a need for indoor recreation space without raising property taxes on locals.

“Tourists place significant strain on our community’s infrastructure and services, such as roads, hospitals, and emergency services, which are funded by local taxpayers,” according to the district’s website. “To ease this burden, we propose charging tourists to help cover these costs and support a facility dedicated to improving the health and wellbeing of everyone in our community.”

Plans adopted in 2023 by Valley County and the City of McCall both identified indoor recreation space as a major need across the county. Currently, gymnasiums in local schools and the Elk Creek Church Celebration Center are among the only options for indoor practice space.

Without donors like you, this story would not exist.

Make a donation of any size here

Those spaces, however, can quickly get crowded as more than 1,000 students, plus city recreation leagues, vie for use of the indoor facilities, according to Lingle, who serves as president of the McCall United Soccer Association.

District organizers also believe the fieldhouse would benefit tourists and local businesses by “creating a vibrant hub for cultural events, festivals, and year-round attractions.”

What do opponents say?

Meanwhile, opponents of the district say the tax could overburden an industry that is already subject to a statewide 8% tax, plus special local taxes in some jurisdictions.

If the district is approved, its tax of up to 5% would raise the rate on short-term lodging to 21% in the City of McCall, 14% in the City of Donnelly, and 13% in the northern half of Valley County.

The Star-News, a weekly newspaper in McCall, reported that local short-term rental managers and motel owners worry the added tax could drive some visitors away from McCall or even be passed onto locals through rising service costs for contractors.

A post by Letters to the Valley County Electorate, a blog helmed by former longtime Star-News publisher Tomi Grote, was critical of the proposal’s framework and warned of the opportunity cost associated with approving the tax.

“That’s roughly $1.5M annually that can never be levied in the future for expenses that are actually tourist-related,” Grote wrote.

The proposed district would qualify as an auditorium district, under state law. It would become the 26th taxing district in Valley County, but could be dissolved in the future with a successful citizen petition and a simple majority vote during an election.

Auditorium districts have previously been approved to build and fund event centers in Boise, Nampa, Pocatello, and Idaho Falls.